QuickBooks® has been around for decades, helping businesses manage their accounting and payroll processes with ease. Today, there is QuickBooks online: A convenient way for companies to keep track of expenses and income in a way that keeps everything neat and tidy, in one place.

The cloud-based version of QuickBooks® is designed to provide excellent reporting options within the accounting application and is suitable for small- to mid-sized businesses. Combining QBO with ClockShark, not only further streamlines your payroll process but helps you get an accurate picture of your exact labor costs.

We recently had an informative webinar with co-host Karine Woodman of 24hr Bookkeeper, on how business owners and managers can use the QBO/ClockShark integration to determine their true labor costs. This resource is based on that webinar, Unsure of Your Exact Labor Costs? Learn How to Master it With QuickBooks and ClockShark.

What Are Labor Costs and Why Is It Important?

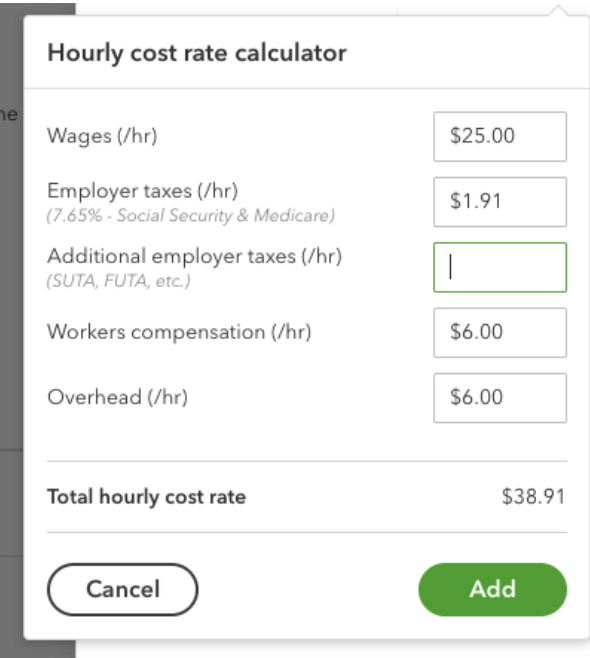

Simply put, labor costs are all wages paid to employees, as well as the costs of their benefits, payroll taxes, and overhead. They include direct and indirect costs.

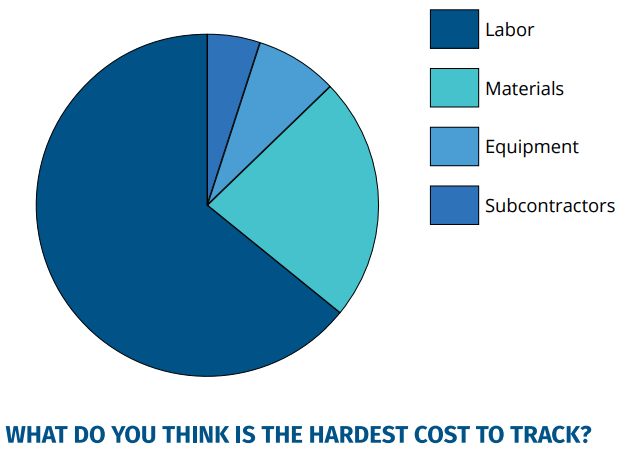

In our webinar, we asked attendees what they felt was the hardest cost to track. Although tracking all expenses is important, the majority - 65 percent - chose labor. There are many reasons why labor costs are difficult to track: multiple job sites, different types of workers, etc. Plus the intangible costs associated with labor make it even more challenging.

Understanding your labor costs is crucial for multiple reasons:

- Getting accurate financials

- Not losing money

- Improving estimate accuracy to stay profitable

The types of insurance can vary depending on the type of work being done so you have to track. For example, insurance to cover electrical work will likely be more than that to cover a general laborer.

That’s why it helps to have a way to accurately track who is doing which job, when, and for how long.

While labor costs are their own category, they are also a part of job costs, as well as things like materials and equipment rentals. This ties into getting your estimates right so you can be sure you’re not running your business at a loss. You’re better able to provide estimates that cover your costs and return the best profit with the correct job costs that give you a clear picture of what your job costs are.

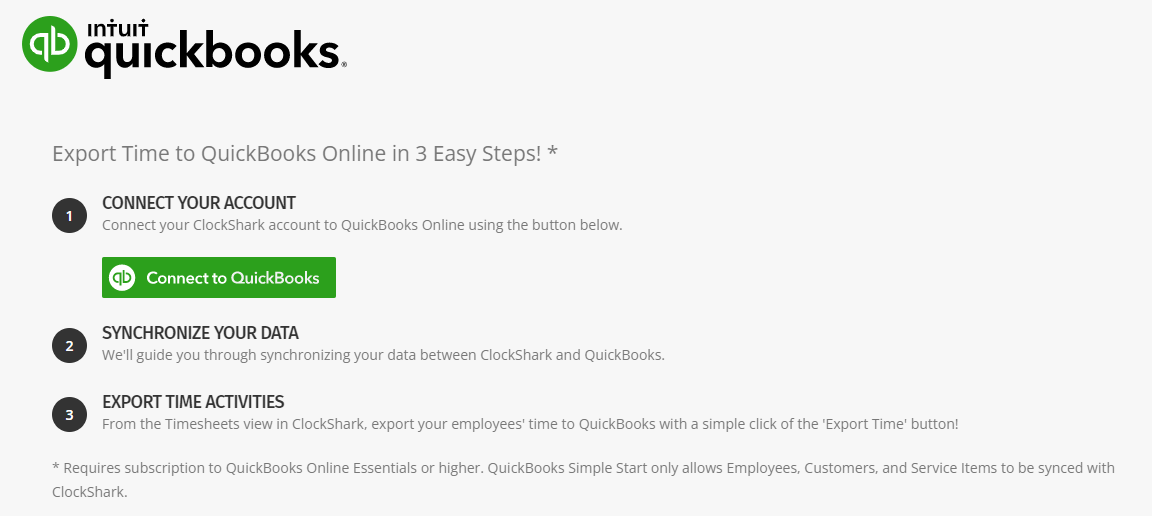

Benefits of Integrating QBO and ClockShark

There are multiple benefits of integrating QBO and ClockShark.

Work smarter, not harder

Since labor costs are among the toughest expenses to track, having an automated process in place that does the work for you, means you can work smarter, not harder. You will also be able to keep track of everything that’s going on with various crews or teams without having to make tons of phone calls or send texts or emails.

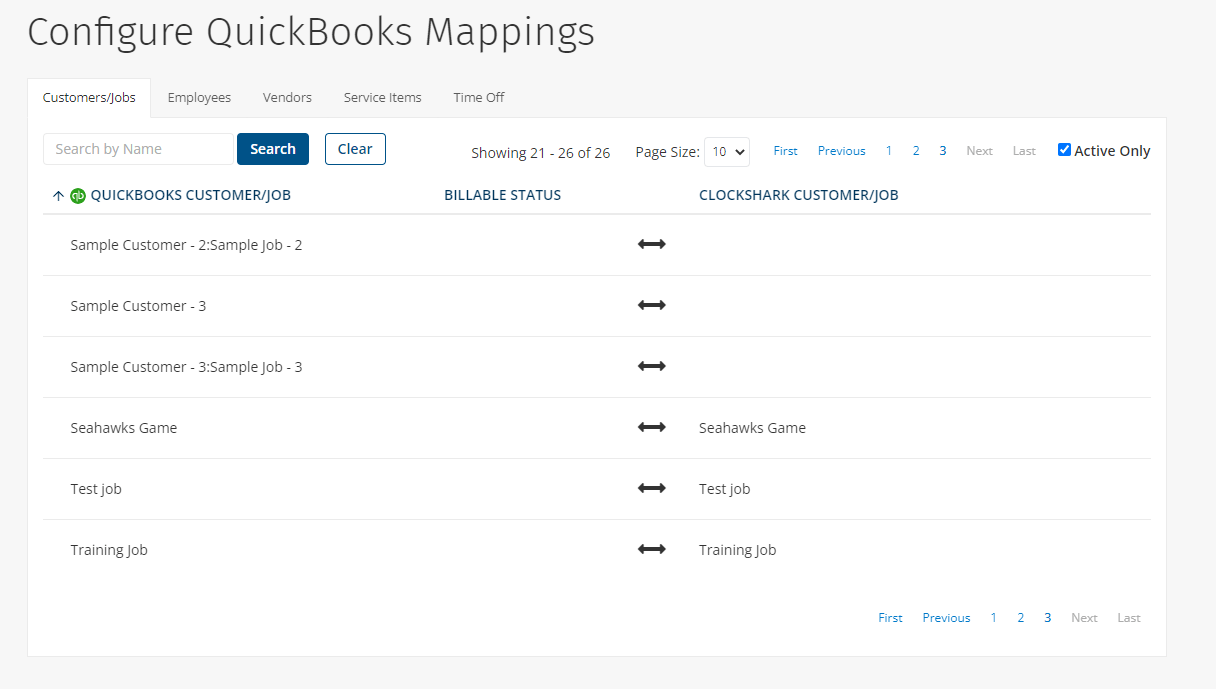

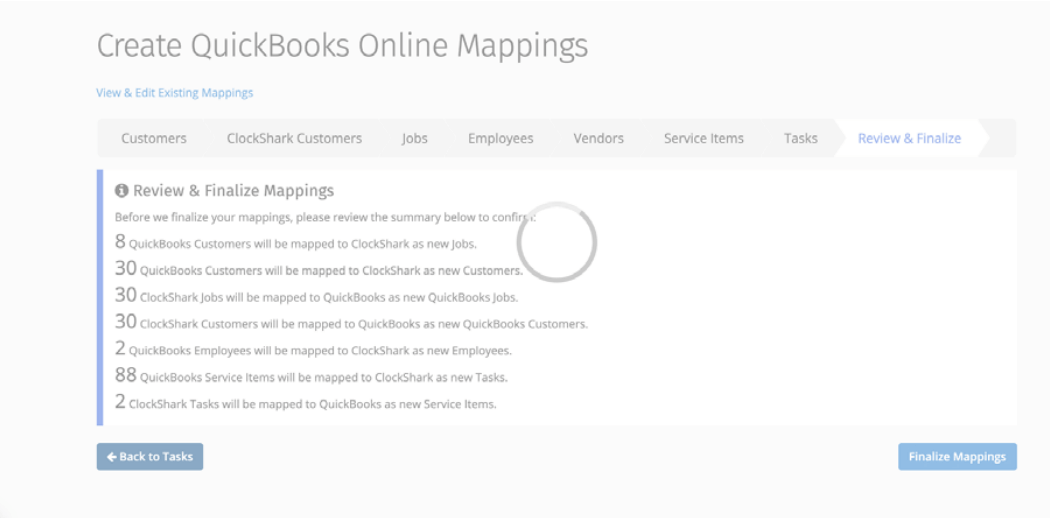

Streamline processes

Streamlining your payroll and labor costing process frees up time for you to focus on other things and not have to worry about mistakes, missing timesheets, or inaccurate data.

Eliminate human error

During our webinar, the majority of attendees reported using an app like ClockShark but paper timesheets came in second. Imagine the frequency of human error with hand-written timesheets or the frustration of waiting for a text to come in.

According to the Economic Policy Institute, between 10 to 20 percent of employers misclassify at least one worker as an independent contractor and, in 2019, the IRS collects billions of dollars in penalties related to payroll taxes, every year. When you have digital records and processes, you reduce the risk of human error because everything is automated.

Real-time information

Being able to access the data when you need to, means you can run reports, get information, or perform audits when it’s convenient for you, at the touch of a button.